About

MJS Commodities is a leading privately held international trading company and a subsidiary of MJS Global Group.

Our team has 200+ years combined experience in the procurement and delivery of commodity products and services.

We specialize in the handling of every element involved in the international trade of physical commodities with the focus on high-quality agro products, precious metals, polished diamonds and gemstones, solid and liquid fuels, and hydrocarbon-free 100% biodegradable packaging we move soft and hard commodities from remote locations to where they are most needed – reliably, professionally and efficiently.

We operate, market and advice on multiple raw materials to various client segments around the globe, whether they are import-export businesses, financial institutions, governments and private investors, through the supply chain and bringing them wherever needed.

Our thoughtful services, diversified product lines, and relationships are advanced with integrity and honest straightforward dealing and go to great lengths to ensure professionalism, excellence, and peace of mind. Whether you’re a producer, an existing or potential partner in government or business, or an end-user we have the focus, passion, and commitment to get you closer to your markets.

We value the success and accomplishments of our principals as we value our company and people. By combining both of our visions, the results are limitless. Our attitude is making all possible efforts, instead of deeming it impossible, with a conviction to take the business deal to successful completion to enrich both our clients and our societies.

Precious Metal Trading Terms

Below are definitions of some of the most commonly used terms in the precious metal investing world.

A

Acid Test

A means of determining the fineness of gold through the use of nitric acid and aqua regia.

Actual Gold Content

The amount of gold that exists in an object after all the alloys have been removed.

Actuals

Physical cash commodities as opposed to futures contracts.

Allocated gold

Allocated gold or silver is physical bullion stored in a professional vault which belongs to the owner outright. Allocated metal does not feature on the vault provider’s balance sheet. It isn’t exposed to their financial performance, because it is not an asset of that company. Allocated gold or silver bullion is the owner’s personal property, held under a custody (or ‘safekeeping’) arrangement.

Alloy

A mixture of two or more metals. Metals such as silver, nickel, copper and zinc are frequently mixed with gold to improve its hardness and/or change its colour.

Annealing

Process of heating and cooling metal to relieve stresses before it is processed.

Anode

Generally refers to impure copper cast into a special shape for incorporating into an electrolytic refinery for the final purification process.

Approved Carriers

Armoured carriers approved by an Exchange for the transportation of silver, gold, platinum, and palladium.

Approved Refiner

One of a select group of refineries whose metal production is seen as meeting standards for purity and appearance. The bars produced at these refineries are accepted for delivery against contracts on Futures Exchanges and on the “Spot” market. Examples of approved gold refiners include, but are not limited to: Johnson Matthey Inc., Royal Canadian Mint, and PAMP Suisse.

Arbitrage

Simultaneously buying and selling a commodity in different markets to take advantage of price differentials.

Argentum Advantage Gold

This mark has been introduced by Byzantium as an iconic symbol that not only guarantees responsibility from mine to retail, but also exceptional fineness and craftsmanship. The following codes are used: EC – Excellent Craftsmanship, AF – Absolute Fineness, CF – Conflict Free, VM – Virgin Metal, CD – Contributes to Development.

Ask

The price at which a dealer offers to sell.

Assay

A test to determine the quality and purity of a gold or silver product. When a gold or silver product ships with an “assay”, this is a guarantee from the assayer that the product in question does indeed contain the described amount and purity of gold or silver.

Assayer

Assayer is an authorized entity (person/institution) that certifies and grades the commodities that are delivered in exchange accredited warehouses.

Assay Mark

The stamp by an assayer on a bar or piece of precious metal to guarantee its fineness.

AU

The chemical symbol for gold which is derived from “aurum”, the Latin word for gold.

Attribution

Identification of a coin by such data as the issuer, date, reign, mint or denomination.

Avoirdupois

The system of weights and measures commonly used in the U.S. and Great Britain in which 16 oz. = 1 pound. It is used for most solid objects except precious metals and gems. One avoirdupois ounce equals 28.35 grams or 437.50 grains.

B

Backwardation

Market situation in which futures prices are lower in each succeeding delivery month. Also known as an inverted market. The opposite of contango.

Bactericides

Materials that kill bacteria, such as silver salts.

Bag Marks

Minor abrasions on an otherwise uncirculated coin, caused by contact between coins in a mint bag.

Bailment

Bailment refers to a legal relationship where physical possession of personal property, is transferred from one person (the ‘bailor’) to another person (the ‘bailee’) who subsequently has possession of the property. It occurs when a person gives property to someone else for safekeeping. Bailment is different from a contract of sale, as it only involves the transfer of possession and not its ownership.

Bank Wire

Funds transferred through the Federal Reserve System from one financial institution to another for the benefit of a specific account.

Bar

A mass of metal cast or shaped into a convenient shape. In the precious metals industry, the words bar and ingot are used interchangeably.

Base Metal

Also known as pot metal is a mixture of non precious metals or an alloy containing neither gold nor silver. It is frequently used as a base for gold-filled, gold plated or rolled gold plate coverings.

Basis

The differential that exists at any time between the cash, or spot, price of a given commodity and the price of the nearest futures contract for the same or a related commodity. Basis may reflect different time periods, product forms, qualities, or locations. Cash price minus Futures price equals Basis.

Beading

Border of raised dots round the rim of a coin.

Beneficiation

Quite a buzzword these days, in the gold sector, beneficiation of product means adding value to gold beyond the price at which gold is traded internationally.

Bid

The price at which a dealer is willing to buy.

Billon

Alloy of copper with less than 50 per cent silver.

Bimetallic

Made of two different metals or alloys; such coins usually have a centre in one metal and outer ring in another.

Bimetallism

Descriptive of coinage consisting of coins in two different metals with a fixed ratio between them, such as gold and silver or silver and bronze.

Bit

(1) Segment of a coin that has been cut up in order to circulate at half or one quarter the value of the entire coin. (2) Nickname of the 1 real piece that circulated in North America in the 17th and 18th centuries, worth one eighth of a dollar, or 12 1/2 cents.

Blank Planchet

A plain metal disc made for coinage which has not yet been struck with an obverse, reverse or edge design.

Boiler room

An enterprise that uses high pressure sales tactics, false or misleading information, and scare tactics, generally over the telephone, to sell overpriced or worthless investments to unsophisticated investors.

Brass

Alloy of copper and zinc.

Brilliant Uncirculated

A coin that has never been in circulation, and is in shiny, new, and immaculate condition.

Brockage

Mis-struck coin with only one design, normal on one side and incuse on the other, caused when a struck coin clings to the die and strikes the next blank to pass through the press.

Broker

An agent who handles the public’s orders to buy and sell securities, commodities or other property in exchange for a commission charged for the service.

Bronze

Alloy of copper and tin.

Bullion

Bullion comprises of precious metals in the form of bars which are 99.5% pure minimum.

Bullion Assay

Analysis of Gold and Silver in bullion using Proof-Corrected Fire Assay. Sample types include mine bullion, fine gold and jewellery as well as dental alloys.

Bullion banks

According to the World Gold Council, bullion banks are investment banks that act as wholesale gold suppliers dealing in large quantities of ‘good delivery bars’. Bullion banks are required to be members of the London Bullion Market Association (LBMA)and are distinct from depositories in that they handle transactions in gold whilst depositories merely store gold bullion. For example, the New York Federal Reserve stores gold for foreign central banks and the US Bullion Depository in Fort Knox houses most of the national gold bullion reserves of the USA. When a central bank conducts gold loans or gold sales, the physical location of the bullion does not necessarily change. The bullion banks conduct the financial transactions and ownership and title transfer takes place in the depository records.

The world’s largest bullion banks will be familiar names to many, whilst the bullion banks that are market-making members of the LBMA are: The Bank of Nova Scotia (Scotia Mocatta), Barclays Bank Plc (Barclays Capital), Credit Suisse, Deutsche Bank AG, Goldman Sachs International, HSBC Bank USA NA, JP Morgan Chase Bank, Merrill Lynch International Bank Limited, Mitsui & Co Precious Metals Inc, Société Générale, UBS AG.

Five of the world’s largest bullion banks come together each day for the London gold fix, a traditional method by which a reference gold price is fixed for the use of participants of the gold market.

Bullion coin

Bullion coin is a coin with symbolic face value and trades at a price with respect to its intrinsic value.

Bull market

A market in which the primary trend is up.

Business Strike

The strike used by the mint to manufacture coins for everyday use. This differs from a proof strike.

Buyer’s Premium

Percentage of the purchase price at auction paid by the winning bidder to the auction house.

Buy/Sell Spreads

The difference between a precious metals trader’s buying prices and selling prices, relative to the spot price of the metal they are trading. Ideally, buy/sell spreads are kept as low as possible.

C

Call

The right, but not an obligation, to buy a commodity or a financial security on a specified date in the future.

Carry Market

A market situation in which prices are higher in the succeeding delivery months than in the nearest delivery month. Also known as contango, it is the opposite of backwardation.

Cash Market

A market in which delivery and payment have to be made within two working days of the transaction date. See Spot Market.

Cast Bar

A cast bar is made by the process of forming a bar in a mould (contrast minted bar).

Cast Coins

Coins made by pouring molten metal into moulds, rather than by striking discs of metal with dies.

Central Bank

Can also be known as a reserve bank. A public institution which has monopoly over currency issue, currency minting, interest rates and regulation of the money supply. They are also responsible for the commercial banking system. Lenders of last resort in times of banking crises.

Central Device

The main design found on either side of a coin.

Certificates

A common mechanism issued by banks to signify ownership of a quantity of precious metals without taking physical delivery. Certificates confirm an individual’s ownership while the bank or third party holds the metal on the client’s behalf. The client saves on storage and personal security issues, and gains liquidity in terms of being able to sell portions of the holdings (if need be) by simply telephoning the custodian. Other investors feel more safe taking physical delivery of the metals themselves.

Certified Gold

A “certified” gold coin is encapsulated in a tamper-proof, sonically-sealed, high security hard plastic holder, with a unique certification number and bar-code permanently sealed inside each coin capsule for the protection of the investor.

Chain of integrity

The chain of integrity ensures the quality of the large bullion bars traded by wholesale dealers. Because each buyer knows the identity of their seller, there is a history of ownership. So if a gold or silver bar ever turns out to be bad, the current owner can challenge their seller, who challenges their seller in turn, back to the metals refiner or dealer who first put it into the circuit. There is no question of tampering in between, because Good Delivery bars must be kept inside specialist third-party vaults to retain their status. The bullion bar’s quality (or ‘fineness’) is thus warranted, reducing transaction costs dramatically for wholesale traders.

Every silver or gold bar held for customers of BullionVault has a chain of integrity. Each bar was made by an accredited refiner on the London Bullion Market Association’s Good Delivery list, and stamped with a unique serial number, the manufacturer’s name or logo, the bar’s weight, and its purity (at least 99.5% gold or 99.9% silver). It has then been kept continuously in approved vaults, and has only ever been shipped by approved carriers. Through the chain of integrity, any problem can then be traced back to the refiner who created it, and any financial loss can be made good. Customers are never at risk.

Chameleon

A broker or dealer who changes his position on an investment to what he thinks will cause an investor to enter into a transaction.

Circulated

Coins that have been distributed to the public as currency. Usually in much worse condition than uncirculated coins.

Clad

Descriptive of a coin with a core of one metal covered with a layer or coating of another.

Clash Marks

Mirror-image traces found on a coin struck with dies that have been damaged by having been previously struck together without a blank between them.

Clipping

Removing slivers of silver or gold from the edge of coins, an illegal but widespread practice until the 1660s, when milled coins began to be struck with grained edges.

Close

A period defined by an exchange and occurring at the end of each trading session wherein any transactions are considered to be made “at the close.” Also known as the “settlement.”

Coin of the Realm

A legal tender coin issued by a government, meant for general circulation.

Coin

Piece of metal marked with a device and issued by a government for use as money.

Coin Weight

Piece of metal of exactly the weight of a known coin, used to check weight and fineness of matching coins.

Collar

Ring within which the obverse and reverse dies operate to restrict the spread of the blank between them; it is often engraved with an inscription or pattern that is impressed on the edge of the coin.

Collateral

Properties, assets or securities that are offered to secure a loan or other credit. Sometimes this collateral is put up to meet a broker or exchange’s margin requirements. Collateral can be seized by the party that extended you the credit if you default. If you have a 50% mortgage on your house, the bank has lent you this money in the knowledge that the other 50% of the house’s value has been pledged as collateral against the loan. If you suddenly become unable to pay your mortgage, the bank can recover their lost income from this collateral.

Gold bullion can be used as collateral, and was considered as a solution to back the debts of European nations of Italy and Greece. Gold Bullion bars have been increasingly accepted in the financial markets by brokers, banks and clearing houses. Clearing houses, that sit as the backstop behind international exchanges, have been seeking to beef up their financial ballast amid market volatility by accepting more gold bullion as collateral. In October 2011 LCH.Clearnet (about the world’s safest financial counterparty) became the latest clearing house to accept gold bullion as collateral.

Commission

The fee charged by a broker for the execution of an order.

Commodity

A physical product which is commonly traded and holds value based on the product’s industrial and commercial value.

Commodity Futures Trading Commission – CFTC

A federal regulatory agency of the United States of America authorized under the Commodity Futures Trading Commission Act of 1974 to regulate futures trading in all commodities. The commission has five commissioners, one of whom is designated as chairman, all appointed by the President, subject to Senate confirmation. The CFTC is independent of the Cabinet departments.

Commodity pool

A venture, usually a limited partnership, in which investors contribute funds for the purpose of buying commodities.

Condition

The condition of a gold or silver bar, round, or coin. Common conditions are “New”, “Varied”, “Brilliant Uncirculated”, “Proof”, “Circulated”, etc.

Conjoined Portrait

Obverse portrait with two heads or busts in profile, facing the same direction and overlapping. Also known as accolated or jugate.

Contango market

A normal futures market in which prices are higher in the succeeding delivery months than in the nearest delivery month. Opposite of backwardation.

Copper

(1) Metal widely used for subsidiary coinage for more than 2500 years, usually alloyed with tin to make bronze, but also alloyed with nickel or silver. (2) Nickname for small denomination coins.

Correction

A decline in prices following a rise in a market.

Counterfeit

A reproduction of a coin by someone other than the government legally authorized to do so.

Countermark

Punch mark applied to a coin to change its value or authorize its circulation in a different state.

Cover

To offset a short futures or options position.

Cupellation

(Latin cupella, little cup) Refining process used to separate gold and silver from lead and other impurities in a bone ash pot called a cupel; used in assaying to determine the fineness of precious metals.

Currency unit

For gold the general market convention is to quote in US $ per ounce. But quotations in other currencies are available upon negotiation. In addition to a US Dollar price, the LBMA Gold Price is settled in US dollars. £ and € prices are also available but these are indicative prices for settlement only.

For silver the general market convention is to quote in US cents per ounce. But as for gold quotations in other currencies are available upon negotiation. In addition to a price in US cents, £ and € prices are also available but these are indicative prices for settlement only.

Current Delivery Month

The futures contract which ceases trading and becomes deliverable during the present month or the month closest to delivery. Also called the spot month.

Custom Smelting

Basically this means that materials received from customers (mostly borax slags and dust) are loaded through an arc furnace, mixed with fluxes and reductant to form three major products: slag, metal and flue dust.

D

Debasement

Reduction of a coin’s precious metal content.

Deliverable Bar

A precious metal (gold and silver, for example) with a weight that is approved as a tradable unit on one or more of the commodity exchanges.

Delivery

Delivery generally refers to the change of ownership or control of a commodity under specific terms and procedures established by the Exchange upon which the contract is traded. Typically, except for energy, the commodity must be placed in an approved warehouse, depository, or other storage facility, and be inspected by approved personnel, after which the facility issues a warehouse receipt, shipping certificate, demand certificate, or due bill, which becomes a transferable delivery instrument. Delivery of the instrument usually is preceded by a notice of intention to deliver.

Delivery Point

A location designated by an exchange at which delivery may be made in fulfilment of contract terms.

Depository

Depositories are storage facilities, similar to professional vaults, that provide a full range of specialised precious metals custody, accounting and shipping services to financial exchanges, institutions and industrial companies. They are another way of storing gold and silver bullion for the professional market. The most famous depository is probably Delaware Depository Service Company (DDSC). The DDSC is used by international exchanges (COMEX & NYSE Liffe), investment banks, brokerages, refiners, major retailers, coin dealers and even retail investors.

Gold investors that use depositories get access to high-security vaults that are typically constructed and maintained in compliance with the Bank Protection Act and UL standards. When you store your gold bullion within a depository, your gold investment typically remains your legal property, and is recorded as a ‘bailment‘ in the records of the depository. As such you maintain ownership of allocated gold bullion bars.

Derivative

A financial instrument derived from a cash market commodity, futures contract, or other financial instrument. Derivatives can be traded on regulated exchanges or over-the-counter. Futures contracts, for example, are derivatives of physicals commodities, and options on futures are derivatives of futures contracts.

Device

A design found on a coin. Frequently it is the bust or profile of a person who symbolizes a particular country at a particular time in history or a country’s coat of arms or insignia.

Die

An engraved metal object used to strike or stamp the design on a coin.

Die Break

Raised line or bump in a relief image caused by a crack in the die.

Divisibility

How many individual elements a precious metals allocation consists of. It is deemed to have more divisibility to hold 10 × 1 ounce gold bars than 1 × 10 ounce bar.

Dodecagonal

Twelve-sided.

Doré

A mix of unrefined and semi-pure alloy of gold and silver, usually created at the site of a gold mine or silver mine to make shipment cheaper.. These bars of gold doré or silver doré are then transported to a refinery for further purification before eventual sale onto the gold market or silver market.

Department of Minerals and Energy – DME

The Department of Minerals and Energy, which is the regulatory body for minerals and energy resources in South Africa.

Dubai Multi Commodities Centre – DMMC

A strategic initiative of the Dubai government, The Dubai Multi Commodities Centre (DMCC) was created to establish a commodity market place in Dubai, and provide industry- specific market infrastructure and a full range of facilities for the gold and precious metals, diamonds and coloured stones, energy and other commodities industries.

DQS

DQS, based in Germany, is the first assessment and certification organization to be authorized for almost all standards and specifications. The service spectrum comprises assessments according to more than 70 recognized standards and technical or industrial specifications, as well as internal company requirements.

Ductility

An ability to change shape drastically without breaking. The capacity of a metal to be hammered into a thin sheet or drawn into a fine wire.

Dump

Coin struck on a very thick blank.

E

Edge

The side of a coin which may be reeded, lettered or plain.

Edge Inscription

Lettering on the edge of coins designed to prevent clipping.

Edge Ornament

Elaboration of the graining on milled coins designed as a security device.

Effigy

Portrait or bust on the obverse of a coin.

Encapsulated

Placed in a protective plastic holder to protect and ensure the quality and condition of the item.

Engraving

Technique of cutting designs and inscriptions in dies used for striking coins.

Error

Mistake in the design or production of a coin.

Exchange of Futures for Physicals – EFP

A futures contract provision involving an agreement for delivery of physical product that does not necessarily conform to contract specifications in all terms from one market participant to another and a concomitant assumption of equal and opposite futures positions by the same participants at the time of the agreement.

Exchange Traded Fund – ETF

This is a publicly traded fund in which you buy shares in gold but never actually hold any physical metal.

F

Federal Reserve

Founded December 1913, US Central Bank, also referred to as The Fed. Responsible for monetary policy, financial stability and financial services. Since 1913 the role of the Federal Reserve has expanded significantly. It first purchased paper assets in 1914.

The Federal Reserve is the single largest gold owner in the world, with a reported holding of over 8,000 tonnes. These gold reserves have not been audited for many decades and the likes of Congressman Ron Paul has been pressing for an audit of the Fed’s gold bullion.

Ferrule

A metal ring or cap put around the end of a pole or shaft to prevent splitting or to give added strength.

Fiat money

Fiat money is paper money that was made legal tender by law but not backed by gold or silver.

Field

Field is the open area or background on a coin.

Findings

Findings are the components that jewellery makers use to assemble their jewellery and include items such as clasps, earring backs and hooks.

Fine Gold Content

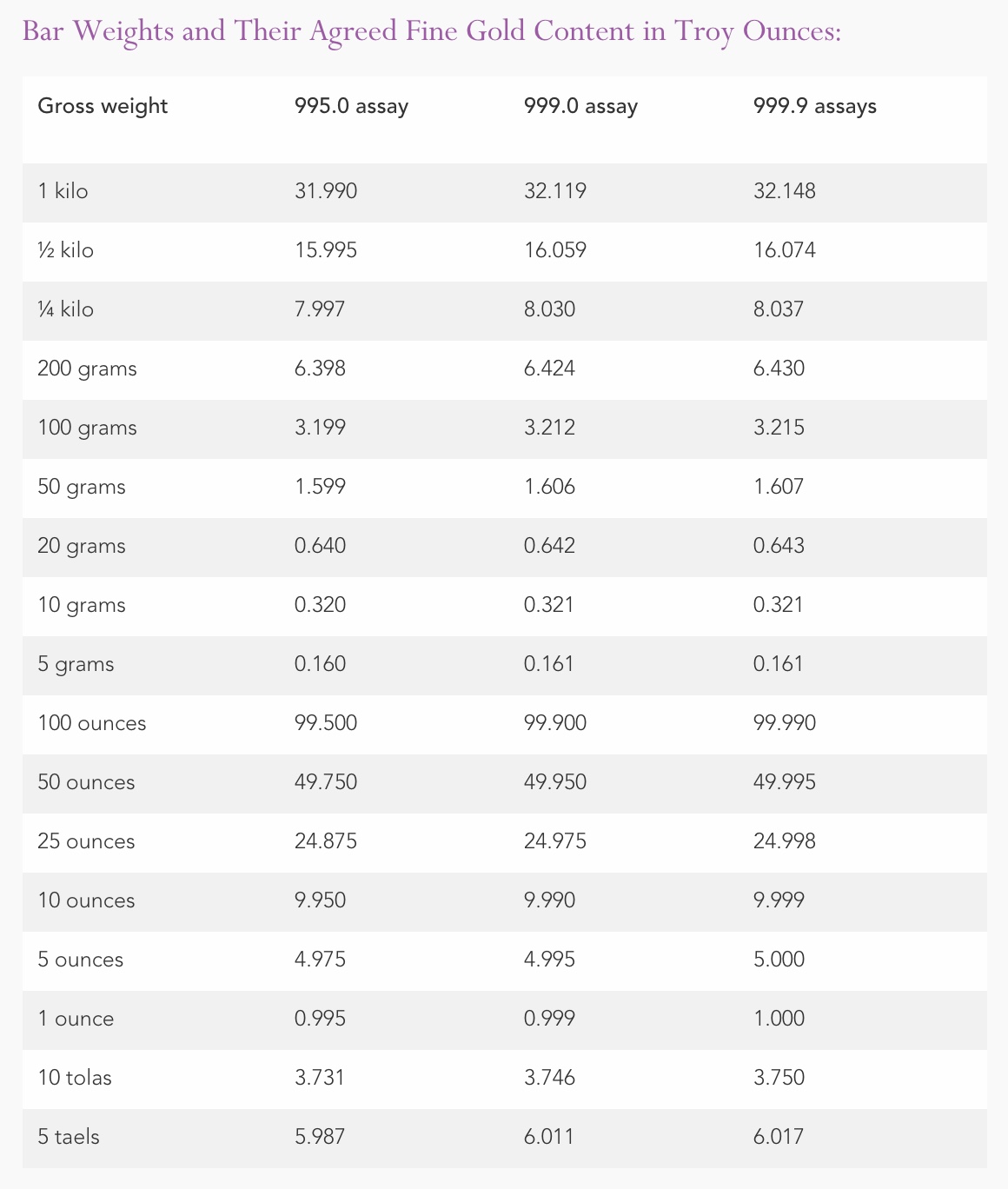

This represents the actual quantity of gold in a bar. For example a good delivery bar may have a gross weight (which includes small quantities of impurities) of 403.775 ounces. If it were of a fineness of say 996.4 fine, the fine gold content or net weight of gold would be 403.775 x 0.9964 = 402.321 fine ounces.

Fine weight

Fine weight is the metallic weight of a coin, ingot, or bar. It is different from item’s gross weight which includes the weight of the alloying metal.

Fineness

Fineness is the purity of a precious metal measured in 1,000 parts of an alloy For instance, a gold bar of .995 fineness means 995 parts of gold and 5 parts of another metal.

Fool’s Gold

Iron pyrite is often mistaken by novices for gold. Although its colour resembles gold, its properties are very different from gold. It is hard and brittle while gold is soft and malleable.

Forwards

This may take the form of a simple purchase or sale of metal for settlement beyond spot, an outright forward, or for forward swap transactions. Forward swaps are a simultaneous purchase and sale where one leg of the transaction is generally for spot value and the other forward, conducted at an agreed differential to the spot leg of the deal. They are in effect collateralised loans of metal. This leads to the terms “borrowing on the swap”, in the case where the spot is purchased and the forward sold, or “lending on the swap” where the spot is sold and the forward purchased, in order to differentiate from leasing metal.

Fractional/Fractional Denomination

A size or amount that is less than the total amount of a whole unit.

Frosting

Matt finish used for the high relief areas of proof coins to contrast with the polished surface of the field.

Fungibility

The property of a good or a commodity whose individual units are capable of mutual substitution, such as crude oil, shares in a company, bonds, precious metals, or currencies.

Fungible Program

In precious metal fungible program, the investor owns a defined interest held by a third party. Instead of taking physical delivery, the investor receives a certificate that describes the investment level.The fungible program is popular for many reasons including the lower premiums over the ‘spot’ price of the metal and the high liquidity.

Futures Contract

A contract between a buyer and seller, whereby the buyer is obligated to take delivery and the seller is obligated to provide future delivery of a fixed amount of a commodity or financial instrument at a predetermined price at a specified location in the future. Futures contracts are most often liquidated prior to the delivery date and are generally used as a financial risk management and investment tool rather than for supply purposes. These contracts are traded exclusively on regulated exchanges and are settled daily based on their current value in the marketplace.

G

Globular

Descriptive of a coin struck on a very thick dump with convex sides.

Gold

A precious yellow metallic element that is resistant to oxidation and is highly ductile and malleable. In the United States, a metal must 10 Karat gold or more to be called gold.

Gold Anti-Trust Action – GATA

GATA, or the Gold Anti-Trust Action Committee, exist to “to expose, oppose, and litigate against collusion to control the price and supply of gold and related financial instruments”. Manipulation of the gold price is alleged to have been occurring for decades with the ‘London Gold Pool‘ being an open and explicit attempt by the Western central banks to suppress the gold price.

GATA was established in 1998 and arose from essays by Bill Murphy, a financial commentator (LeMetropoleCafe.com), and by Chris Powell, a newspaper editor. GATA was then formed and formally incorporated in Delaware in 1999. Bill Murphy then became chairman and Chris Powell became secretary and treasurer. GATA has collected and published dozens of documents showing Western treasury and central bank efforts to intervene both openly and surreptitiously against a free market in gold.

GATA holds international conferences for gold investors where a range of our favourite gold commentators often speak. These conferences have so far been held in Durban, South Africa, in 2001, Dawson City, Canada, in 2006; Washington, D.C., in 2008, and in London in 2011.

Gold banking

Gold banking at its purest is essentially where money is 100% backed by gold, and is not fiat money like we use today. In a gold banking system the banking and payments system depends totally on gold as its basis. A gold banking system could be 100% backed, and not a fractional reserve banking system like we have today.

Whilst a gold banking system might be close of unimaginable to many individuals today, gold has been at the centre of our financial system since the dawn of civilisation. A range of prominent gold investors advocate a return to a gold banking system and sound money, and believe that this is essential to social progress and the financial system best suited to preserving our liberty and freedom.

Gold bug

Gold investor with a very strong degree conviction about the strengths and benefits of gold bullion bars as an asset class.

Gold Carry Trade

The Gold Carry Trade was a trade executed by major bullion banks and other financial institutions, often during the 1980s and ’90s, that is said to have compounded the effects of central bank activity of gold sales and gold loans on the gold price during these decades. These decades constituted the 20 year bear market in the gold price, after the bull market of the 1970s, and is well described by Ferdinand Lips in his book ‘Gold Wars‘ (Lips’ book is often deemed a must read book for gold and silver investors). With their enthusiasm to borrow leased gold from the central banks, the bullion banks made spectacular sums of money by executing the Gold Carry Trade. The bullion banks borrowed gold at a 1% lease rate, sold this gold (thereby putting more selling pressure on the market) and invested the proceeds in US Treasuries at a 5% yield. The Gold Carry Trade depended on a spread existing between the Gold Lease Rate and apparent risk free rate of return provided by the US treasury market.

Gold Electroplate

Process by which 24 karat gold is deposited on another metal electrolytically. The plating must be at least seven millionths of an inch thick.

Gold-Filled (GF)

A process by which a layer of at least 10 kt. gold has been mechanically bonded to another metal (usually a base metal). This layer usually constitutes AT LEAST 1/20th of the total weight of the metal in the piece. Items are marked G.F. preceded by the karat fineness of the veneer. For example if a bracelet is marked 1/20 10 kt. G.F. and weighs one Troy ounce it is possible to determine the pure gold content by performing the following calculation. Pure gold content = 1/20

Gold Fixing

The ‘gold fixing’ is short for the London gold fix. This is the traditional process by which a reference price of gold is determined twice each working day in the London bullion market. Held twice each working day at 10.30am and 3.00pm GMT.

Gold Flashed

A gold coating which is less than seven-millionths of an inch thick. It is sometimes called gold washed.

Gold Loan

The provision of finance in gold for a gold-related project or business, typically in mining or jewellery inventory finance, which provides a combination of generally inexpensive funding together with built-in hedging.

Gold miner

Business or enterprise engaged in extracting gold from the earth’s crust and processing the mined material to the end product of gold bullion bars.

There are several gold mining techniques and processes by which gold may be extracted from the earth. These can be divided into three general categories: placer mining (there are 4 variants of this form of gold mining), hard rock mining and by-product mining.

Gold mining companies may choose to refine their extracted gold deposits into gold bullion before selling to the gold market or may prefer to sell their gold extracted gold in doré bar form to a refinery.

Gold Nugget

Placer gold which has been washed out of the rocks generally into river beds where it has been beaten by the water and rocks into a “nugget” shape.

Gold Plate

A common term for electro-gold plating.

Gold price

The gold price is the rate at which gold trades in relation to a number of fiat currencies. The most referred to gold price is that quote in dollars per troy ounce. This dollar per ounce gold price has become the gold market’s reference price because the US dollar is the current international reserve currency. However, gold is not denominated only in US dollars and is priced in every currency.

Good Delivery

Good Delivery bars are cast by a small group of precious metal refiners, approved by the professional bullion dealing community. These bars then stay inside accredited storage, moving only from recognized vault to recognized vault, until they are finally withdrawn by the end-user. At that point, the chain of integrity is broken, and Good Delivery status is lost.

The phrase Good Delivery typically refers to London Good Delivery (see LBMA), the premier standard internationally. But there are other “lists” of approved refiners for some other markets, such as the Comex futures exchange in the US. Good Delivery bars are accurately assayed and must meet strict rules on fineness, weight, shape and marking.

Because the chain of integrity ensures the quality of London Good Delivery bars, they are warranted to be 99.5% pure gold or better, or 99.9% silver. The market only trades pure gold content (gross bar weight x purity) which is known as fine gold. No-one who trades professional market gold ever pays for impurities. Because silver fineness is greater, and the value is lower by weight, silver is traded gross. Good Delivery bars are large – around 400 troy ounces each (12.4kg) for gold, and around 1,000 ounces of silver (31.1kg).

Gold Mining Companies

Publicly traded mining companies offer exposure to precious metals at the producer level, but this category has underperformed other vehicles due to a variety of challenges including high company debt levels, rising labour costs and environmental issues. In addition to subpar performance, buying individual producers magnifies risk when compared to diversified holdings.

Gold-Silver Ratio

The amount of silver you can buy with one ounce of gold, based on present spot prices. Ex: a gold-silver ratio of 50 means that one ounce of gold would buy fifty ounces of silver at present prices.

Gold Standard

A monetary system based on convertibility into gold; paper money backed and interchangeable with gold.

Grading Service

A company that grades numismatic coins. Generally, graded coins are encapsulated in plastic, a procedure called “slabbing.” PCGS and NGC are the two dominant grading services in the United States.

Gram

The basic unit of weight of the metric system A metric unit of mass and weight. A gram equals approximately 1/32 Troy oz. and is used in Troy weight as a measure of gold. (31.1035 grams = one troy ounce.)

Granules

Bullion, including its various alloys presented for sale in granulated form, often referred to as grain.

Green Gold

Please see Responsible Gold.

H

Hallmark

Hallmark is a mark or stamp on a bullion item which identifies the producer.

Hammered

Descriptive of coins struck by hand, using a hammer to impress the dies.

Hedge

A transaction initiated with the specific intent of protecting an existing or anticipated physical market exposure from unexpected or adverse price fluctuations.

Holding Bullion

Precious metals can be purchased and held in the form of bars or coins. Gold bars typically carry a very low margin over spot prices but can be cumbersome. Gold coins such as one-ounce South African Krugerrands also trade close to spot prices and offer more flexibility for investors who are buying or selling in quantities less than 400 troy ounces, which is the standard gold bar size.

Hub

Right-reading metal punch used to strike working dies.

I

Incuse

Descriptive of an impression that cuts into the surface of a coin.

Inflation

The classical economic definition of inflation is an increase in the money supply and available credit (the use of which increases the money supply). Nowadays, though, inflation is most often used to mean higher prices. Because the word conveys two meanings, monetary inflation and price inflation are sometimes used for clarification.

Ingot

A mass of metal cast into a convenient shape. In the precious metals industry, the words ingot and bar are used interchangeably.

International Standardization Organization – ISO

A network of national standards institutes in 153 countries on the basis of one member per country. The Central Secretariat is based in Geneva and the South African member of the ISO is the South African Bureau of Standards (SABS).

Intrinsic value

Intrinsic value is the actual value of a coin’s metal content.

Inverted market

A situation in which prices for future deliveries are lower than the spot price. Also known as backwardation.

Investment Grade

A term that refers to coins in higher grades, usually Mint State-65, Proof-65, or higher. Only semi-numismatic and numismatic coins are graded as bullion coins derive their value from the metal bullion and not the rarity and/or condition of the coin.

J

Junk Silver

Any silver product that contains less than 90% silver content. Junk silver products usually contain between 35% and 90% silver. Ex: pre-1965 US coins.

Just-In-Time Stocks

These are gold or silver bars which are warehoused by the RRL close to the client’s premises, to ensure a fast supply when required. The stock is paid for by the client when the metal is taken out of the stock.

K

Karat

Karat is a unit to measure of the purity of a precious metal. For example, Pure gold is 24 karat.

Both the terms “karats” and “carats” refer to precious metal purity. However, for the sake of clarity, “carats” usually refers to diamond weight.

You usually hear about karats in connection with gold. The higher the karat number, the more valuable the metal. The karat is a simple way of stating the ratio of precious metal in an item to other alloys. For example, a 10k gold necklace is 10 parts gold, 14 parts other metals. Here are other common karat labels and the purity to which they refer:

• 24k = 99.95%+

• 22k = 91.66%

• 18k = 75%

• 14k = 58.33%

Bullion, by definition, is as close to 100% pure as it can get, so expect gold bullion products to be 24k. Mints usually stamp the weight and purity of their products on all their coins and bars. Gold jewelry products also have a purity stamp on them (though you may need a loupe and some patience to find it). Most gold jewelry is between 10k and 18k, because pure gold is too soft to stand up to everyday wear and tear.

Kilo bar

Kilo bar as the name suggests is a bar weighing one kilogram or approximately 32.1507 troy ounces or 1000 grams. It is the world’s most widely traded small gold bar, popular among investors and jewellery manufacturers as it is normally sold at an extremely low premium above the prevailing value of its gold content.

Klippe

Coin struck on a square or rectangular blank hand-cut from sheet metal, originally in a time of emergency.

Koala

Koala is Australian platinum coin casted in 1987.

Krugerrand

Krugerrand is South African gold coin.

L

Laureate

Descriptive of a design incorporating a laurel wreath, either adorning the brows of a ruler or enclosing the value.

LBMA Good Delivery Lists

Lists of acceptable refiners of gold and silver whose bars meet the required standard (of fineness, weight, marks and appearance) of the London Bullion Market Association.

Leases

Gold and silver may be placed on deposit, borrowed or lent, like currency with interest calculated on the basis of troy ounces of gold or silver. It is uncollateralised lending. In order to differentiate and to avoid confusion with forward swaps, this activity is termed “leasing”. Firms therefore “lend on the lease” or “borrow on the lease”.

Legal Tender

Coin declared by law to be current money and that can be used as national currency. Ex: The 1 Ounce American Gold Eagle has legal tender of $50 USD.

Legend

Legend is the inscription on a coin.

Lettered Edge

Intaglio lettering milled onto the edge of a coin before striking or raised lettering on the edge of a coin produced by the use of a segmented collar die at the time of striking.

Licensed Warehouse

Warehouse that has been approved for the storage of silver or gold deliverable against a silver or gold futures contracts.

Licensed Weightmaster

An organization approved by an exchange to witness and verify the weighing of silver or gold delivered against a silver or gold futures contract.

Liquidity

The ease of buying and selling a certain product or metal. Ex: 1 Ounce Silver Bars are extremely liquid, as there is a huge active base of both buyers and sellers.

Loco London Spot Price

This is the basis for virtually all transactions in gold and silver in London. It is a quotation made by dealers based on US dollars per fine ounce for gold and US dollars per ounce for silver. Settlement and delivery for both metals is two business days in London after the day of the deal.

Dealers can therefore offer material of varying fineness, bar size or form – for example, grain – at premiums to cover the costs of producing smaller, exact weight bars, or bars of a fineness above the minimum 995 fine.

London Bullion Market Association – LBMA

The London Bullion Market Association (LBMA) represents the wholesale gold and silver market worldwide. Its members provide the banking, dealing, vaulting and transport services which buyers and sellers need to trade large-bar gold and silver efficiently. To ensure the quality of material, the LBMA issues and maintains on behalf of its members the Good Delivery List of bullion refineries, who are approved to produce the large bars accepted by the London market. These wholesale bars must meet strict standards of fineness, weight, shape and markings.

The LBMA’s nine market-making members, all of whom are international investment banks, undertake to quote firm buy and sell prices throughout the day for gold and silver delivered inside accredited London vaults. BullionVault is the only ordinary member of the association dedicated solely to providing precious metals to private individuals. The LBMA’s small executive team also represent the market’s interests to governments and regulators, and arrange various social functions for networking, such as the annual LBMA conference – widely seen as the premier event for gold and silver worldwide.

London Gold Delivery Referee

To become an LBMA-approved London Good Delivery Referee a refinery has to demonstrate its ability to conduct assays of gold and silver to the highest possible levels of precision and accuracy; manufacture gold and silver reference samples free from detectable inhomogeneity, assayed to very high levels of accuracy and meet very demanding sample manufacturing standards (99,5 fineness upwards for gold and 99,9 for silver). All referees have to conduct over 7 000 assays to become accredited.

London Metal Exchange – LME

The London Metal Exchange is the world’s premier non- ferrous metals market.

Logistics

The international transport and storage of precious metals, including specialized security due to the nature of the goods.

Luster

A frosty appearance on the surface of a coin, usually an un-circulated coin.

M

Malleable

Having the property of being deprived of form, accepting deformation under pressure or hammering without rupture or fracture.

Marketable Amounts

The standard dealing amounts between market makers in the spot market are 5,000 fine ounces in gold and 100,000 ounces in silver. The usual minimum size of transaction is 2,000 troy ounces for gold and 50,000 troy ounces for silver while dealers are willing to offer competitive prices for much larger volumes for clients.

In the forward market, subject to credit limits, London’s market makers quote for at least 50,000 fine ounces for gold swaps versus US dollars, and for at least one million ounces of silver.

Markup

The amount to a coin or bar’s cost to reach the selling price

Market Value

The price at which a coin or bullion item trades.

Medallion

Medallion is a round piece of metal resembling like a coin.

Melt Value

The value of a coin or bar based on the precious metal content then multiplied by the price of the metal.

Metric ton

A metric ton is 1,000 kilograms or 32,151 troy ounces.

Miller Chlorination Process

This is a pyrometallurgical process whereby gold doré is heated in furnace crucibles. The process is able to separate gold from impurities by using chlorine gas which is added to the crucibles once the gold is molten. Chlorine gas does not react with gold but will combine with silver and base metals to form chlorides. Once the chlorides have formed they float to the surface as slag or escape as volatile gases. The surface melt and the fumes containing the impurities are collected and further refined to extract the gold and silver.

This process can take up to 90 minutes produces gold which is at least 99.5% pure with silver being the main remaining component. This gold can be cast into bars as 99.5% gold purity meets the minimum London Good Delivery requirements of the London bullion markets.

However some customers such as jewellers and other industrial end users require gold that is almost 100% pure, so further refining is necessary. In this case, gold using the Miller process is cast into anodes which are then sent to an electrolytic plant. The final product is 99.99% pure gold sponge that can then be melted to produce various end products suited to the needs of the customer.

Mint

The refining or fabricating company which created a certain bar, round, or coin. Ex: Golden State Mint.

Mintage

The total number of coins struck of a specific coin.

Mint mark

Mint mark is a letter or symbol stamped on a coin to recognize its minting facility.

Mis-strike

Coin on which the impression of the die has been struck off-centre.

Modern issues

Current coins, whether struck for circulation or for sale to investors or collectors.

Money Order

Order for the payment of a specified amount of money, usually issued and payable at a bank or post office.

Monster Box

Mint-issued boxes used to store and protect coins during shipping.

MS-60

The lowest grade of Mint State coins. Higher-grade coins are labeled MS-61 up to MS-70. Coins showing wear are graded below MS-60 and fall into grades from AU down to G, with G being a coin showing great wear and AU being a coin showing little wear.

Mule

Coin whose obverse and reverse designs are wrongly matched. Can be comprised of different denominations or even separate foreign currencies.

N

New York Close

Because of the time differences, the New York gold market continues to sell precious metals for several hours after the London market has closed for the business day. Its last price has this name, and it may be higher or lower than the London fix depending upon market fluctuations.

Nickel

Base metal used extensively in coinage as a substitute for silver, frequently alloyed with copper to make cupro-nickel.

Non-Fungible

Opposite of fungible. Product is not interchangeable.

Non-Segregated

Items are physically intermingled with one another while in custody without regard to any special distinction, status or difference among them (also referred to as “bulk storage”).

Nugget

Nugget is modern gold bullion coin created by Australia which is .9999 fine.

O

Obverse

The “front” side of a coin, usually bearing a head or face design.

Offer

A motion to sell a commodity at a specified price. Opposite of bid. The Offer price is the price at which a dealer offers to sell a commodity.

Off-metal

Descriptive of a coin struck in a metal other than that officially authorized.

Option

The right, but not an obligation, to buy or sell a commodity or a financial security on a specified date in the future.

Ore

Originally from the Old English for crude or unwrought metal. It refers to any economic mineral deposit of precious or other metal.

Other Bullion Bars

In addition to Good Delivery bars, a variety of smaller exact weight bars are available to wholesale clients. The fine gold content of exact weight bars determines their price as clients only pay for the fine gold content (and not for the small amount of impurities which may be present). A kilo bar, for example, weighs one kilogram, which is 32.1507465 ounces. If the fineness of the bar was 995.6 then the fine gold content would be 32.009 ounces. Silver kilo bars are purchased and sold as one kilo of 999 fine silver.

Ounce/Troy ounce

Ounce is a unit used for measurement of weight. An ounce means a troy ounce equal to 31.1035 grams.

Overdating

Method of changing a date without the expense of engraving an entirely new die. One or more digits are altered by superimposing other numerals using a punch.

Overstrike

Coin produced when a previously struck coin is substituted for a blank, on which traces of the original design remain.

P

PAMP

Pamp is a precious metals refiner established in 1977 and based in Ticino, Switzerland. Pamp is a member of the LBMA and one of the small group of precious metal refiners that produce 400 troy ounce Good Delivery gold bars.

Paper Precious Metals

Any precious metal investment that doesn’t result in the investor holding gold or silver in hand. Ex: precious metal ETFs, precious metal certificates, etc.

Parallel Stream Sampling

Refers to the process whereby two samples are taken simultaneously from the same feed material in order to verify that the end result would not have a variance of more than 1%. This means that if sample A has a specific grade, sample B should not vary by more than 1% when compared to sample A. If this is not the case, the deposit is resampled to ensure that the required conditions are met.

Patina

Surface quality acquired as a result of environmental interaction over time, such as the oxidation of metal.

Pattern

Design piece prepared by a mint for approval by the issuing authority, not actually put into production. Patterns may differ from issued coins in metal or minor details, but many bear designs quite different from those eventually adopted.

Pellet

Raised circular ornament, sometimes used as a spacing device in the inscription.

Pennyweight

Equals 24 grains or 1/20 of a Troy ounce.

Physicals market

A marketplace in which the physical product is traded, as opposed to a futures market where “contracts” are traded and physical delivery of the product may or may not take place.

Pile

Lower die bearing the obverse motif, the opposite of the trussel.

Platinum Group Metals (PGMs)

Refers to six metallic elements clustered together in the periodic table. These elements are all transition metals, and include ruthenium, rhodium, palladium, osmium, iridium, and platinum. They have similar physical and chemical properties, and tend to occur together in the same mineral deposits.

Poured Bars

Mints can make poured bars from several precious metals, including gold, silver, platinum and palladium. Higher heat is needed to make gold bars, however. Twenty-four-karat gold has a melting point of about 1,945 degrees Fahrenheit while pure silver has a melting point of only 1,761 degrees. The lower heat required makes it easier for mints to create poured silver bars than gold bars.

Poured bars usually cost more than pressed bars for two reasons. One being that they are generally larger and the second being that they often require a human to physically pour the metal. Needing to have a human present in order to complete the process makes it more time consuming and costly. This also means that a mint can only produce a limited amount of the bars in most cases.

Precious Metals

Refer to the classification of metals that are considered to be rare and/or have a high economic value. The higher relative values of these metals are driven by various factors including their rarity, uses in industrial processes and as investment vehicles. The most popular precious metals with investors are gold, platinum and silver, and precious metals used in industrial processes include iridium, which is used in specialty alloys and palladium, which is used in electronics and chemical applications.

Premium

In the physical gold market, premium means the extra price charged in Asia’s large dealing centres, over and above London prices. Notably quoted in Mumbai, Hong Kong and Shanghai, the premium is typically priced in US dollars per ounce, and reflects local conditions. It rises when demand rises faster than importers can arrange new deliveries of large Good Delivery gold bars out of London – heart of the world’s physical gold market – through Swiss refineries, and into Asia as kilobars, the preferred investment form locally.

Pressed Bars

Mints can use practically any precious metal to make pressed bars, as well, although gold and silver are two of the most common options. Pressed bars give mints more control over quality and uniformity, so many companies prefer using this method.

Since pressing bars doesn’t require melting metal into a liquid, mints that focus on pressing don’t always need fires capable of reaching nearly 2,000 degrees. That saves some money, but the mints also have to purchase the supplies needed to cut and stamp pressed bars.

Pressed bars will usually cost less, but for the same reason that poured bars cost more. However, some pressed bars may also have designs that make them collectors’ items. If a bar is considered a collectors’ item, prices are often higher than the metal’s melt value.

Privy Mark

Secret mark incorporated in a coin design as a security device or to identify the particular die used.

Proof

A coin that has been struck with greater pressure than normal using special dies to make the design more highly polished. Proof coins are collectibles and trade at a higher premium than brilliant uncirculated or circulated versions of the same coin.

Punch

Piece of hardened metal bearing a design or lettering used to impress a die or a coin.

Purity

The gold or silver content contained within a bar, round, or coin. Usually displayed as .XXX. Ex – .999 1 Ounce Silver Bars, indicating 99.9% purity.

Put

An option that gives the owner the right to sell a commodity or a financial security on a specified date in the future.

Q

Quoting Conventions

Prices are expressed in US dollars per fine troy ounce for gold and US cents per troy ounce for silver. Prices against other currencies or in units of weight other than troy ounces are generally available on request.

R

Rally

An advancing price movement following a decline in a market.

Raw Gold

Bullion coins that have not been certified or encapsulated.

Recoinage

Process of recalling and demonetizing old coins, which are then melted down and made into new coins.

Refinery

An industrial plant that uses mechanical and chemical means to purify a substance to convert it to a form that is more useful.

Refining

The separating and purifying of gold and silver from other metals.

Relief

Raised parts of the design.

Restrike

Officially issued reproduction of a former circulating coin.

Restrikes

Are “new” coins made from “old” dies which is why they are referred to as “new mintings”. Restrikes generally have the same specifications as the original coins of which they are copies – this includes the same dates, composition, and dimensions. Restrike coins are officially produced by a government mint and they are usually not legal tender. Government mints pick one date as the “restrike date” for a particular coin. For instance, the restrike date for the Austrian 100 Corona is 1915. Restrikes are considered bullion coins because such a large number were made that they have no numismatic value. In fact, the original coins made from the dies used for restrikes have no numismatic value because there is no way to tell them from the copies.

Responsible Gold

All gold produced by Byzantium is responsible gold which follows the ‘Chain of Custody’ requirements consistent with the Organization of Economic Co-Operation and Development’s (OECD) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict Affected and High Risk Areas. It further complies with the London Bullion Market Association (LBMA) Responsible Gold Guidance and the World Gold Council certification of ‘Conflict-Free’ gold.

Responsible sourcing of gold includes consideration of the following:

• No dealings with Conflict Gold

• Conflict: armed aggression between two or more parties which leads to severe abuses of human rights.

• Conflict Zone : The area in which armed aggression is taking place.

• Conflict Gold: Gold which enables, fuels or maintains conflict.

• Safety, health and the environment: The gold is mined and produced without endangering the safety and health of people or damaging the environment.

• Social responsibility: The gold mining company or entity cares for and uplifts the community in which it operates.

Reverse

The “back” side of a coin, with an alternate design usually displaying the coin’s purity and face value.

Rim

Raised border around the outside of a coin’s face.

Rolled Gold Plate (RGP)

Jewellery which consists of LESS than 1/20 of 10 karat to 14 karat gold by weight. For example, a RGP bracelet weighing 1 Troy oz. might be

Rounds

Short for 1-oz silver rounds, which are privately-minted .999 fine round pieces of silver about the sizes of silver dollars.

S

Safe Haven Asset

A safe haven asset is where people typically invest in times of political turbulence or uncertainty. Gold is known as the ultimate safe haven.

Scissel

Clippings of metal left after a blank has been cut; sometimes a clipping accidentally adheres to the blank during striking, producing a crescent-shaped flaw.

Scrap Gold

The broad term for any gold which is sent back to a refiner or processor for recycling

Segregated Storage

Your gold/silver coins or bars are kept apart from other investor’s precious metals. Just as importantly the gold/silver does not fall onto the balance sheet of either the dealer or the storage facility. This means that in the event of either another investor, the dealer, or indeed the storage company itself going bankrupt, your precious metals are fully protected and cannot be touched by creditors.

Semi-Fabricated Jewellery

Gold that has been particularly processed to create items that are used by manufacturing jewellers in the creation of jewellery. eg. wire, granules, plates, bangles and rings.

Series

All the issues of a coin of one denomination, design and type, including modifications and variations.

Settlement and Delivery

The basis for settlement of the loco London quotation is delivery of a standard London Good Delivery bar at the London vault nominated by the dealer who made the sale.

While currency settlement or payment for a transaction will generally be in US dollars over a dollar account in New York, delivery of metal against transactions in gold and silver are in practice made in a number of ways. These include physical delivery at the vault of the dealer or elsewhere, by credit to an “allocated account” or through the London clearing process to the “unallocated account” of any third party.

In addition to delivery at its own vault, a dealer may, by agreement, arrange delivery of physical metal to any destination around the world. Many dealers maintain consignment stocks of physical bullion around the world to facilitate efficient and speedy delivery in active bullion centres.

Settlement Price

The price established by the Exchange settlement committee at the close of each trading session as the official price to be used by the clearinghouse in determining net gains or losses, margin requirements, and the next day’s price limits. The term “settlement price” is often used as an approximate equivalent to the term “closing price.” The close in futures trading refers to a brief period at the end of the day, during which transactions frequently take place quickly and at a range of prices immediately before the bell.

Therefore, there frequently is no single closing price, but a range of prices. In months with significant activity, the settlement price is derived by calculating the weighted average of the prices at which trades were conducted during that period.

Short Sale

The sale of an asset for future delivery without possession of the asset sold.

Silver

Latin name Byzantium. The chemical symbol is Ag.

Slabbed coins

Slabbed coins are coins encapsulated in plastic for protection against wear and tear. Generally, “slabbed” coins are graded by one of the two major grading services.

Smelter Assay

Analysis of Gold and Silver in “low-grade” Smelter feed material by Lead Collection followed by Cupellation and Parting; also used in conjunction with spectroscopy to determine Platinum, Palladium and Rhodium. Sample types include: slag, matte, carbon and electronic scrap.

Solid Gold

The Federal Trade Commission rules state that the term “solid gold” can be applied to items which are not hollow and contain at least 10 kt. or finer gold.

Specie

(Latin, “in kind”) Money in the form of coins, especially of precious metals.

Spectroscopy

State of the Art instrumentation includes WDXRF, ICPOES, Spark OES (TRS), UV-VIS and Combustion Analysis (LECO). Sample types include mine bullion, fine gold and silver, high purity gold and silver and jewelry and dental alloys.

Spot

The price for the physical delivery of bullion bars, usually 100-oz bars of gold or platinum and 1,000-oz bars of silver.

Spot and Forward Value Dates

Settlement and delivery for spot transactions is two good business days after the day of the deal (a good business day is defined as one in which banks are open in London for delivery of the gold or silver and in New York for settlement of dollars).

The value dates for standard forward quotations are at calendar monthly intervals from spot. Should that day be a non-business day, the value will be for the nearest good business day except at month ends when the value date will be kept in the month which reflects the number of months being quoted for.

Spot Gold Price

The constantly fluctuating price of gold in unfabricated form. The live, up-to-date price of gold or silver. Determined by the latest trades on the futures market, as well as over-the-counter markets. The closing spot price varies with markets located in numerous cities and countries throughout the world. It is recommended that one follow the spot gold close from one particular source in order to consistently gauge the fluctuations in the world markets. Commonly quoted gold markets include: New York City, Chicago, Handy and Harmon, Engelhard, Republic National Bank, London, Zurich, Paris,Frankfurt, and Hong Kong. Note that when buying gold in the United States, the price will generally be based on the prices in New York or Chicago.

Spot Market

A market in which delivery and payment have to be made within two working days of the transaction date.

Spread

The difference between the buying price and the selling price of an object at the same time on the same day by the same person. If gold is purchased at $400.00 per ounce, and sold at $390.00, the spread is $10.00.

Sterling Silver

A standard of silver defined by law as 925 parts pure silver per 1000 parts overall. Sterling silver is the principal standard in the UK and USA.

Symbolic Face Value

Nominal value given to legal tender coins sold for their metal content. Example: the 1-oz Gold Eagle carries a $50 face value but sells for the value of its gold content plus a premium of 5% to 8%.

T

Tael

Traditional Chinese unit of weight for gold, widely traded in the Far East. 1 tael = 1.20337 troy ounces = 37.4290 grams. The nominal fineness of a Hong Kong tael bar is 99 but in Taiwan 5 and 10 tael bars can be 999.9 fine.

Token

Coin-like piece of metal, plastic or card issued by merchants, local authorities or other organizations, often during periods when government coinage is in short supply, but also produced extensively as a substitute for money.

Tokyo Commodity Exchange – TOCOM

Established in 1984, it is Japan’s largest and one of Asia’s most prominent commodity futures exchanges. TOCOM operates electronic markets for precious metals, oil, rubber and soft commodities.

Tola

One Tola is equal to 11.7 grams or 180 grains or 0.375 troy ounce.

Tola bars

Gold bars measured in tolas, the most popular of which is the 10-tola cast bar (3.75 troy oz). Although manufactured in Europe, tola bars are traded primarily in the Middle East, India, Pakistan, and Singapore.

Trade Coin

Coin produced for use outside the country of origin as part of international trade, such as British and American trade dollars.

Trading Unit

For gold, this is one fine troy ounce, and for silver, one troy ounce. In the case of gold, the unit represents pure gold irrespective of the purity of a particular bar, whereas for silver it represents one ounce of material of which a minimum of 999 parts in every 1,000 will be silver. Fineness is a measure of the proportion of gold or silver in a bullion bar and is expressed in terms of the fine metal content in parts per 1,000, and as such it defines the purity of a gold or silver bar. Assaying is the process by which fineness is determined.

Troy Ounce

The traditional unit of weight used for precious metals. The term derives from the French town of Troyes, where this unit was first used in the Middle Ages. One troy ounce is equal to 1.0971428 ounces avoirdupois. In the bullion market, all references to ounces mean troy ounces. One kilogram is equal to 32.1507465 fine troy ounces. A typical gold bar weighs approximately 400 fine troy ounces, so it would weigh approximately 12.44 kg, ie 400/32.1507465.

Truncation

Stylized cut at the base of the neck of a portrait, sometimes the site of a mint-mark, the engraver’s initials or a die number.

Trussel

Upper die used in hammered coinage bearing the reverse design, the opposite of the pile.

Tube

A plastic container used to store coins, rounds or bars.

Type

A major variety of a series of coins.

Type Set

Set comprising one coin of each type in a series.

U

Unallocated gold

Unallocated gold is a bookkeeping device by which a bank or other enterprise provides you with notional gold. The gold is a liability to you on their balance sheet. It is synonymous with gold ‘accounts’ and its holders are unsecured creditors. BullionVault users are only able to trade allocated gold.

Uniface

Coin with a device on one side only.

Unit for Delivery of Loco London Gold

This is the London Good Delivery gold bar. To meet the required standard it must satisfy certain criteria. It must have a minimum fineness of 995.0 and a gold content of between 350 and 430 fine ounces with the bar weight expressed in multiples of 0.025 of an ounce – the smallest weight used in the market. Bars are generally close to 400 ounces or approximately 12.5 kilograms.

Unit for Delivery of Loco London Silver

This is the London Good Delivery silver bar. To meet the required standard it must satisfy certain criteria. It must have a minimum fineness of 999 and a recommended weight between 750 and 1,100 ounces, although bars between 500 and 1,250 ounces will be accepted. Bars generally weigh around 1,000 ounces. Both gold and silver bars must conform to the specifications for Good Delivery set by the LBMA. Further information can be found in the Good Delivery section.

V

Variety

Coins that differ from their basic design type in some distinctive way and are thus differentiated by collectors.

Vault

A place of safekeeping for precious metals, with high security measures in place for access.

Vermeil

Gold plating on another metal – usually silver.

Vis-à-vis

(French, “face-to-face”) Descriptive of a double portrait in which the two heads face each other.

W

Weight

The stamped weight of a bar, round, or coin. Ex: 1 Ounce Silver Bars.

Wet Chemical

Traditional Wet Chemical techniques including gravimetric, titrometric and potentiometric. Sample types include solutions, effluents and electrolytes.

White Gold

A gold alloy containing whitening agents such as silver, palladium or nickel as well as other base metals. Often used as a setting for diamond jewellery.

Wohlwill Process

The electrolytic method of gold refining was first developed by Dr. Emil Wohlwill of Norddeutsche Affinerie in Hamburg in 1874. Dr. Wohlwill’s process is based on the solubility of gold but the insolubility of silver in an electrolyte solution of gold chloride (AuCl3) in hydrochloric acid.

World Gold Council

The World Gold Council is the market-development organisation for the gold industry. Its 23 members comprise the world’s leading gold mining companies, representing approximately 60% of global corporate gold production.

Working within the investment, jewellery and technology sectors, as well as consulting on government affairs, the World Gold Council’s purpose is to provide industry leadership, whilst stimulating and sustaining demand for gold. It made an investment in BullionVault in 2010, acquiring an 11% stake. In 2016, it transferred its holding to Gold Bullion Investment Trust [GBIT] which became the registered owner. GBIT is a connected organisation of the World Gold Council.

X

XF (Extra Fine)

Items that are in Extra Fine condition. All design elements are sharp and well defined.

Y

Year

The year of issue for a gold or silver coin. Ex: 2012 Silver American Eagle

Z

Zinc

Metal alloyed with copper to produce brass; zinc-coated steel was also widely used in Europe during both World Wars.