About

MJS Commodities is a leading privately held international trading company and a subsidiary of MJS Global Group.

Our team has 200+ years combined experience in the procurement and delivery of commodity products and services.

We specialize in the handling of every element involved in the international trade of physical commodities with the focus on high-quality agro products, precious metals, polished diamonds and gemstones, solid and liquid fuels, and hydrocarbon-free 100% biodegradable packaging we move soft and hard commodities from remote locations to where they are most needed – reliably, professionally and efficiently.

We operate, market and advice on multiple raw materials to various client segments around the globe, whether they are import-export businesses, financial institutions, governments and private investors, through the supply chain and bringing them wherever needed.

Our thoughtful services, diversified product lines, and relationships are advanced with integrity and honest straightforward dealing and go to great lengths to ensure professionalism, excellence, and peace of mind. Whether you’re a producer, an existing or potential partner in government or business, or an end-user we have the focus, passion, and commitment to get you closer to your markets.

We value the success and accomplishments of our principals as we value our company and people. By combining both of our visions, the results are limitless. Our attitude is making all possible efforts, instead of deeming it impossible, with a conviction to take the business deal to successful completion to enrich both our clients and our societies.

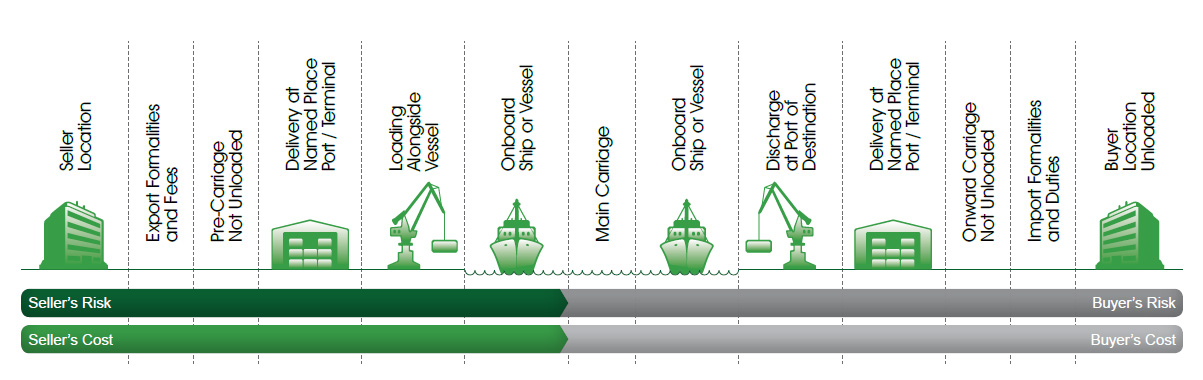

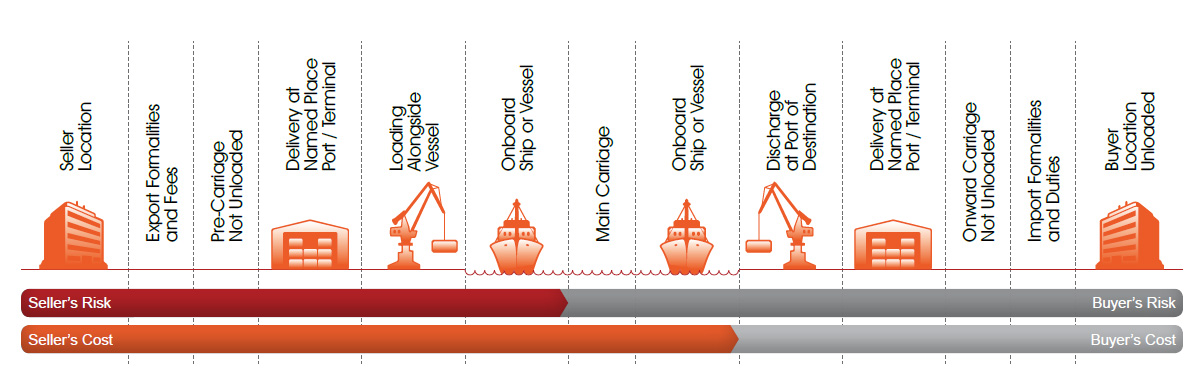

Incoterms Guide

Due to the fact that countries have different business cultures and languages, it’s wise to have a clearly-written contract to reduce any misunderstandings. Thus, the main benefit of Incoterms is reduced risk in a transaction.

By specifying the exporting seller’s and importing buyer’s obligations, there is no confusion with regards to rules of transportation from point A to point B. Incoterms do not cover, however, ownership or title transfer of the goods. These terms are agreed upon separately between the two transacting parties.

‘Incoterms’ has become a stock term in the international freight world. In fact, it is a word that is copyrighted by the International Chamber of Commerce (ICC). Following some years of discussion and drafting within the ICC, they issued the first International Commercial Terms (Incoterms) in 1936. There have been 5 revisions since then, up to the latest – Incoterms 2010.

What is meant by Incoterms is a set of rules governing the distinct types of transportation around the World. It codifies what is meant by each of the (currently) 11 identified and generally accepted types of freight transaction that can be used between sender and recipient. It helps them to understand who owns the goods at each stage, who is responsible in each case for the actual task of shipping, who pays for the various cost elements, and who bears the associated risks (i.e. who pays in the event of damage or loss, at a given point).

The United Nations Commission on International Trade Law (UNICTRAL) recognises these terms as being the global standard for transportation, and they are available in 31 languages through ICC.

It should be noted that the parties to a shipping transaction may agree between themselves to use a previous version, most likely the immediate predecessor, Incoterms 2000. The vast majority of trade, however, is being done using Incoterms 2010.

What is the ICC?

Based in Paris, ICC was founded in 1919. In the chaos that followed WW1, a group of industrialists and financiers were determined to try to bring some order into world trade and to establish some rules and agreements that would make it easier to do business across borders and foster open trading. Its member companies now come from over 120 countries.

ICC’s biggest achievements include a code of documentary credits practice for banks, a standard of advertising practice, and of course, Incoterms.

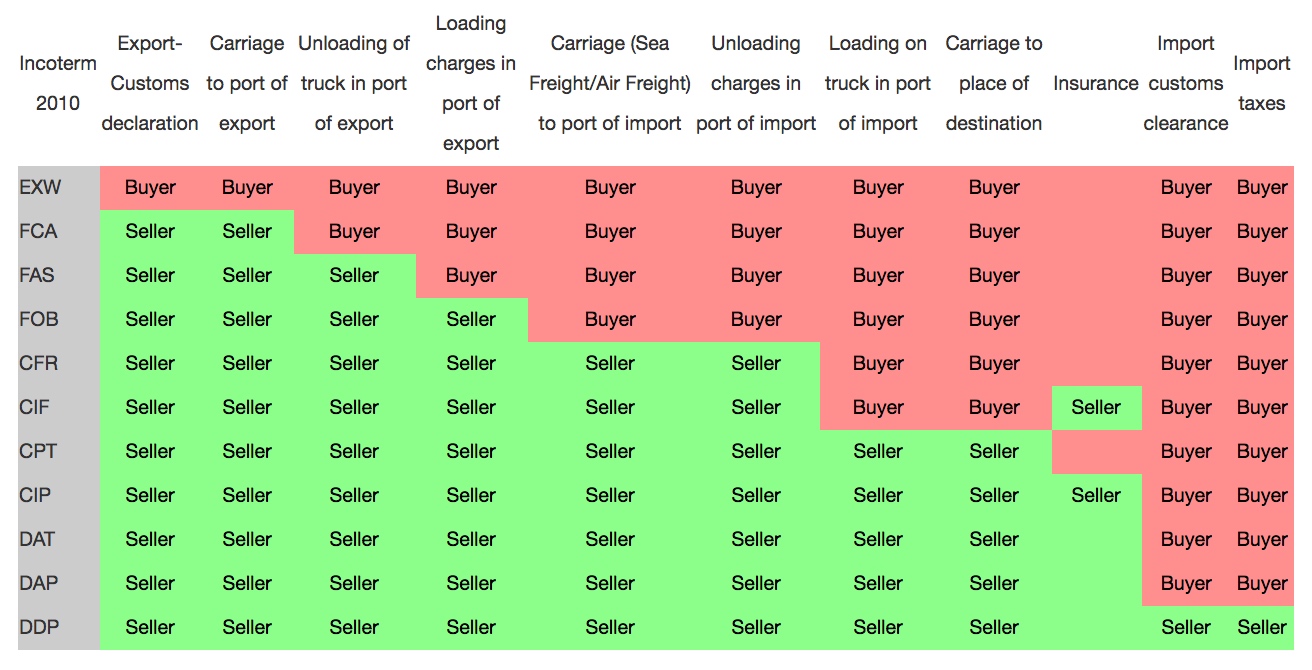

Incoterms 2010

This latest version was launched in September 2010 but actually came into being on 1st January 2011. This sometimes leads to confusion, with people referring to Incoterms 2011; and you may hear references to Incoterms 2012 or Incoterms 2013. They are not, however, updated annually and the correct reference is currently ‘Incoterms 2010’.

As we shall see, the Incoterms are described by 3-letter acronyms that aim to make them well-known and understood anywhere, regardless of language.

This latest edition contains 11 terms. The first 7 are applied to any form of transportation: the final 4 are applicable only to sea or waterway freight.

It is important to understand the concept of ‘delivery’ as it is understood in the freight industry. It does not always mean the physical arrival of the goods at their destination. It actually means the point at which the seller completes his contractual obligation (so in the case of Ex Works, that is when the buyer loads a lorry with the goods at the seller’s plant).

It may also help to note the significance of the first letter in the terms:

C terms require the seller to pay for shipping.

D terms mean that the seller or shipper’s responsibility ceases at a specified point, and they deal with who will pay pier, docking and clearance charges.

E terms mean that when the goods are ready to leave the seller’s premises, his responsibility ceases.

F terms mean that the primary cost of shipping is not met by the seller.

Most Small Business Fall under C- term

As a small business, how do you navigate all of these rules? In particular, small businesses need something that is convenient for the buyer, but at the same time mitigates costs and risks to the buyer.

The best Incoterm class for small businesses would be the C-term rules. In particular, CIF is the most common because there will be a stronger grasp on shipments. In this scenario, the seller takes responsibility for all costs until the cargo is loaded at the origin port, but the cost passes to the buyer at the specified discharge port.

Coupled with a sophisticated shipment tracking system and order fulfilment service, the competitive advantage of a small business with international clients will be given to those who use Incoterms wisely.

Section A – Any mode of transport

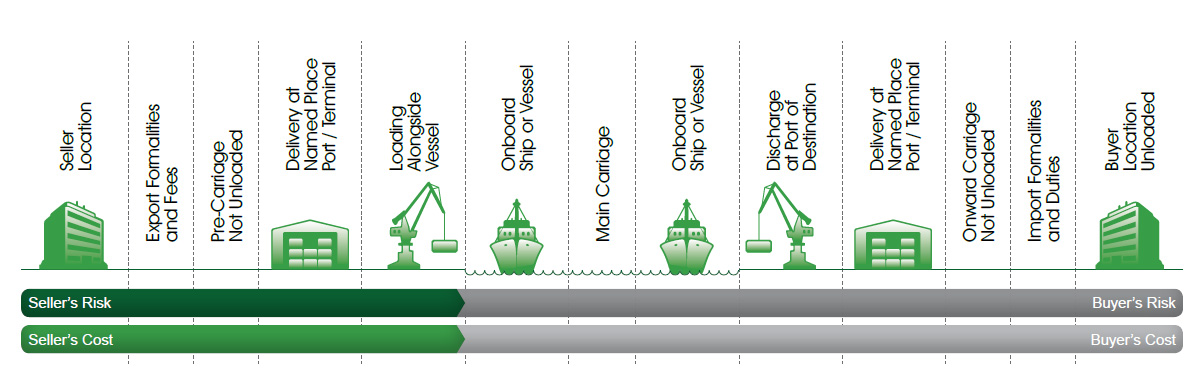

1. EXW Incoterms – Ex Works (named place of delivery)

‘Ex Works’ is also the typical basis of making initial quotations when the actual shipping costs at a given time are not known. It places the greatest responsibility with the buyer, while the seller has minimum obligations in the whole shipping process because the buyer covers all costs from seller’s door to the final destination.

The seller just makes the goods available at the agreed date and ready for collection, which is commonly the seller’s factory, mill, plant or warehouse. The buyer is held accountable for all subsequent costs and risk, and responsible for loading, transportation, clearance and unloading at the seller’s premises unless the specific wording is added to the contract to vary this term.

In practice, it is not uncommon that the seller loads the goods onto the vehicle at the risk and cost of the buyer or even free of charge. Such an agreement must be made within the contract of sales.

The EXW term should not be used if the buyer cannot handle the export formalities. In these instances, use FCA instead.

Seller’s Obligations

- Goods, commercial invoice and documentation

- Export packaging and marking

Buyer’s Obligations

- Loading at seller’s location

- Export licenses and customs formalities

- Pre-carriage to terminal

- Loading charges

- Main carriage

- Discharge and onward carriage

- Import formalities and duties

- Cost of pre-shipment inspection

2. FCA Incoterms – Free Carrier (named place of delivery)

In Free Carrier, the seller is responsible for export clearance and delivery of the goods to the carrier at the named place of delivery.

The buyer is to clearly specify the precise point of delivery in the contract of sales or carriage.

If the named place of delivery is the seller’s place of business, the seller is responsible for loading the goods. If the named place is the carrier’s premises, the seller is not responsible for unloading.

A carrier is any person or company who undertakes the carriage, such as a shipping line, airline, trucking company, railway or freight forwarder.

The buyer normally pays for carriage to the port of import, and risk passes to him when the goods are handed over to the first carrier, even though ‘delivery’ may not take place until the destination. The buyer also pays for insurance.

Seller’s Obligations

- Goods, commercial invoice and documentation

- Export packaging and marking

- Export licenses and customs formalities

- Pre-carriage to terminal

- Delivery to named place of delivery

- Proof of delivery

Buyer’s Obligations

- Unloading from arriving means of transportation

- Loading charges

- Main carriage

- Discharge and onward carriage

- Import formalities and duties

- Cost of pre-shipment inspection

3. CPT Incoterms – Carriage Paid To (named place of destination)

Carriage Paid To requires the seller to clear the goods, deliver them to the carrier and pay for the carrier to the named place of destination. Insurance is not required from the seller.

The transfer of risk from seller to buyer occurs at a different point than the transfer of cost.

The seller’s risk ends with delivery to the carrier while the buyer’s risk begins when the carrier receives the goods from the seller. However, the buyer is only responsible for additional costs after the goods arrive at the final destination.

The term CPT is often used in air freight, containerized ocean freight, small parcel shipments and “ro-ro” shipments of motor vehicles.

A carrier is any person or company who undertakes the carriage, such as a shipping line, airline, trucking company, railway or freight forwarder.

Seller’s Obligations

- Goods, commercial invoice and documentation

- Export packaging and marking

- Export licenses and customs formalities

- Pre-carriage and delivery

- Loading charges

- Delivery at named place of destination

- Proof of delivery

Buyer’s Obligations

- Risk starting at port of shipment

- Import formalities and duties

- Cost of pre-shipment inspection

4. CIP Incoterms – Carriage and Insurance Paid to (named place of destination)

This is commonly used in road/rail or road/sea container shipments and is the multimodal equivalent of CIF.

In Carriage and Insurance Paid To, the seller assumes all risk until the goods are delivered to the carrier at the place of shipment – not the place of destination.

Same as CPT, but the seller is obligated to secure minimum insurance coverage. The risk passes when the goods are handed over to the freight forwarder, who in practice supplies the insurance element and the buyer is responsible for all risks until the freight reaches the named place of destination.

A carrier is any person or company who undertakes the carriage, such as a shipping line, airline, trucking company, railway or freight forwarder.

In multimodal shipments, the place of shipment is the first carrier used.

Seller’s Obligations

- Goods, commercial invoice and documentation

- Export packaging and marking

- Export licenses and customs formalities

- Pre-carriage and delivery

- Loading charges

- Delivery at named place of destination

- Proof of delivery

- Insurance

Buyer’s Obligations

- Risk starting at port of shipment

- Import formalities and duties

- Cost of pre-shipment inspection

5. DAT Incoterms – Delivered at Terminal (named terminal at port or place of destination)

In this system (new in Incoterms 2010)Delivered At Terminal refers to the seller pays for delivering the goods to the arrival terminal, (excluding import clearance). Up to the point that goods are unloaded at the terminal, the risk remains with the seller.

Goods are placed at the disposal of the buyer at the named terminal, at the named port or place of destination. It is important to clearly specify the precise point at or within the terminal where the goods will be unloaded.

DAT is used irrespective of the mode of transport selected and may also be used where more than one mode of transport is utilized. The specific point within the terminal at the place of destination should clearly be specified as agreed upon.

DAT requires the seller to clear goods for export, where applicable, without any obligation to clear the goods for import, pay import duty or carry out import customs formalities.

Seller’s Obligations

- Goods, commercial invoice and documentation

- Export packaging and marking

- Export licenses and customs formalities

- Pre-carriage and delivery

- Loading charges

- Main carriage

- Delivery at named terminal at port or place of destination

- Proof of delivery

Buyer’s Obligations

- Onward carriage

- Import formalities and duties

- Cost of pre-shipment inspection

- Delivery to buyer

6. DAP Incoterms – Delivered at Place (named place of destination)

Also new in Incoterms 2010, this is identical to DAT, except in Delivered At Place the seller delivers when the goods are placed at the disposal of the buyer, on the arriving means of transport, ready for unloading at the named place of destination. Seller’s assumes responsibility for the cost and risk (excluding import clearance) is right up to the point that the goods are ready for unloading by the buyer at his chosen destination. Therefore, clearly specify the precise point of delivery at or within the named place of destination.

DAP is used irrespective of the mode of transport selected and may also be used where more than one mode of transport is utilized. The point within the agreed place of destination should be specified as clearly agreed upon. The risk to this point belongs to the seller.

If the seller incurs costs under the obtained contract of carriage related to unloading at the place of destination, the seller is not entitled to recover such costs from the buyer, unless otherwise agreed between both parties.

DAP requires the seller to clear goods for export, where applicable, without any obligation to clear the goods for import, pay import duty or carry out import customs formalities.

Seller’s Obligations

- Goods, commercial invoice and documentation

- Export packaging and marking

- Export licenses and customs formalities

- Pre-carriage and delivery

- Loading charges

- Main carriage

- Delivery to place of destination

- Proof of delivery

Buyer’s Obligations

- Unloading from arriving means of transportation

- Import formalities and duties

- Cost of pre-shipment inspection

- Delivery to buyer

7. DDP Incoterms – Delivered Duty Paid (named place of destination)

This is the polar opposite to EXW: With Delivered Duty Paid, the seller assumes all responsibilities, costs, risks and obligations, including import duties, taxes, clearance fees etc., right up to the destination point, where the buyer is then responsible for unloading the shipment.

(You may also come across the unofficial phrase “Free In Store” – FIS – for this term).

The seller is responsible for all costs and risk until the goods are unloaded and must pay both export and import formalities, fees, duties and taxes.

The buyer is free of any risk or cost until the goods are unloaded from the vehicle at the named place of destination which is usually the buyer’s place of business.

Seller’s Obligations

- Goods, commercial invoice and documentation

- Export packaging and marking

- Export licenses and customs formalities

- Pre-carriage and delivery

- Loading charges

- Main carriage

- Proof of delivery

- Import formalities and duties

- Cost of all inspections

- Delivery to named place of destination/buyer

Section B – Sea and inland waterway transport only

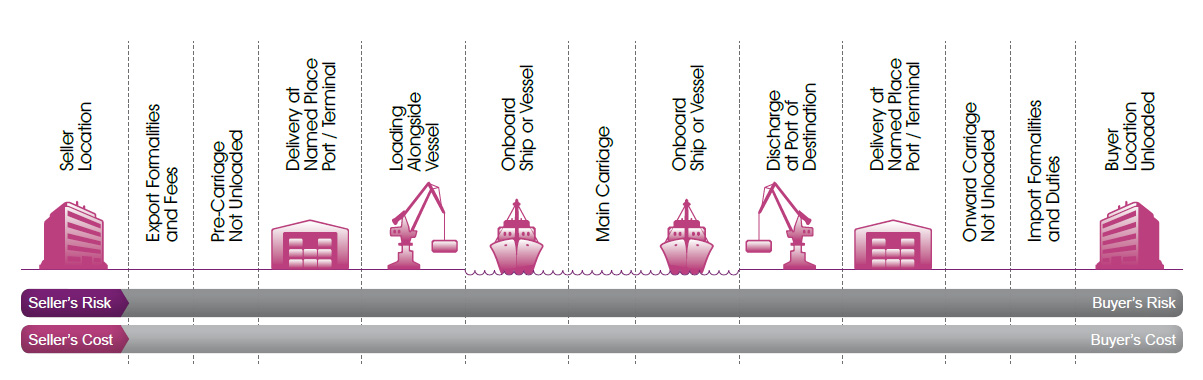

8. FAS Incoterms – Free Alongside Ship (named port of shipment)

This is revised in Incoterms 2010, in Free Alongside Ship, the goods are cleared for export by the seller or, more typically, his shipper/freight forwarder, and placed alongside the vessel at the named port of departure. The location can be a loading dock or a barge.

Note that this is not a multimodal term, but is used for heavy and bulk cargoes.

The seller pays all expenses until the freight is loaded by their forwarder onto the vessel. In that point, delivery is made: and thereafter, the buyer’s forwarder is responsible for loading the freight onto the vessel, local carriage, discharge, import formalities, insurance and duties and onward carriage to the final destination.

FAS applies to ocean or inland waterway transport only and is popular with bulk cargo, such as oil or grain.

For containerized shipments which are delivered only to the terminal, the term FCA should be used.

Seller’s Obligations

- Goods, commercial invoice and documentation

- Export packaging and marking

- Export licenses and customs formalities

- Pre-carriage to terminal

- Delivery alongside vessel at port of shipment

- Proof of delivery

Buyer’s Obligations

- Loading charges

- Main carriage

- Discharge and onward carriage

- Import formalities and duties

- Cost of pre-shipment inspection

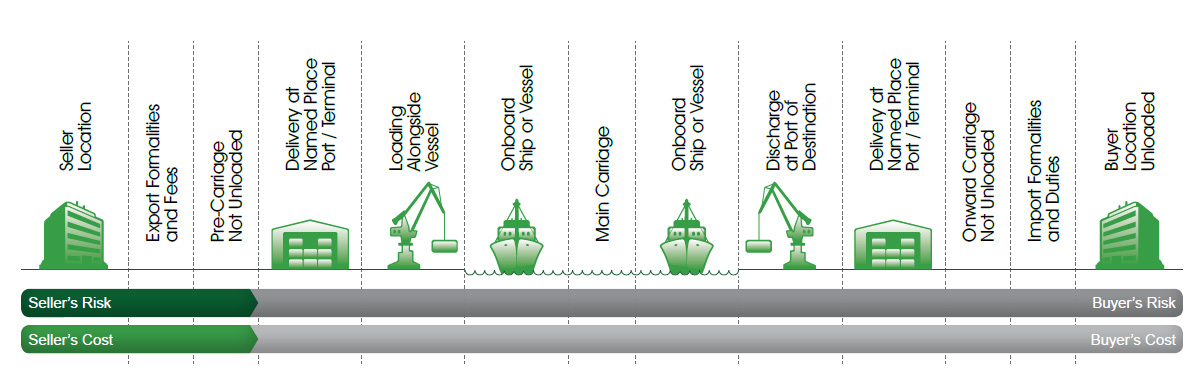

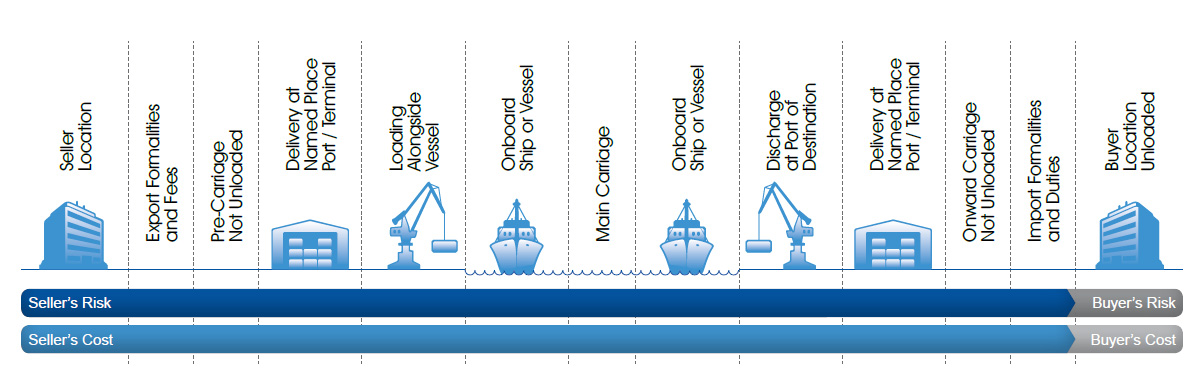

9. FOB Incoterms – Free on Board (named port of shipment)

Be wary of the misleading nature of this common phrase and how it is often misused. It is to be used only for exclusively water transportation. Do not use it for road/rail/sea multimodal container transportation – use FCA instead.

In FOB, the seller clears the goods for export and loads the goods on the vessel and at the named port of departure nominated by the buyer.

New for Incoterms 2010 is that cost and risk are divided when the goods are actually on board: but delivery occurs when the goods are on board ship.

The seller takes over risk and costs starting from the time the goods have been loaded. In addition, the seller is responsible for import clearance and duties.

Seller’s Obligations

- Goods, commercial invoice and documentation

- Export packaging and marking

- Export licenses and customs formalities

- Pre-carriage and delivery

- Loading charges

- Delivery onboard vessel at named port of shipment

- Proof of delivery

Buyer’s Obligations

- Main carriage

- Discharge and onward carriage

- Import formalities and duties

- Cost of pre-shipment inspection

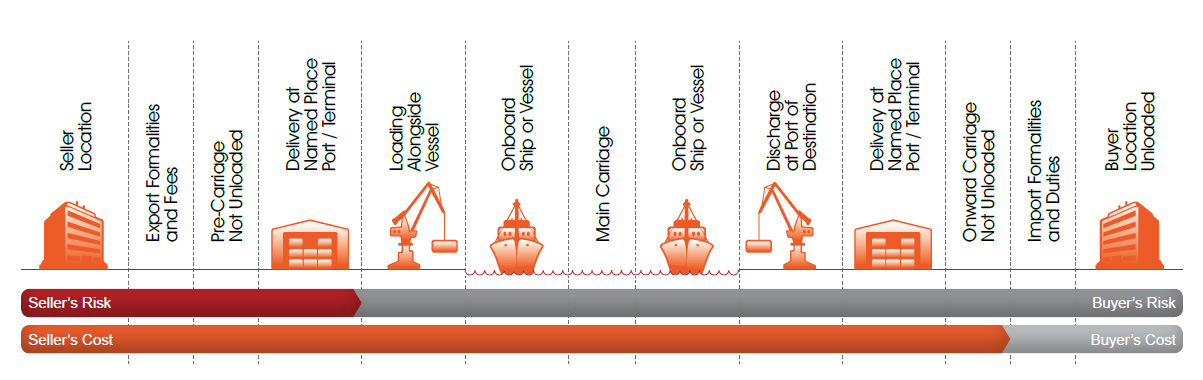

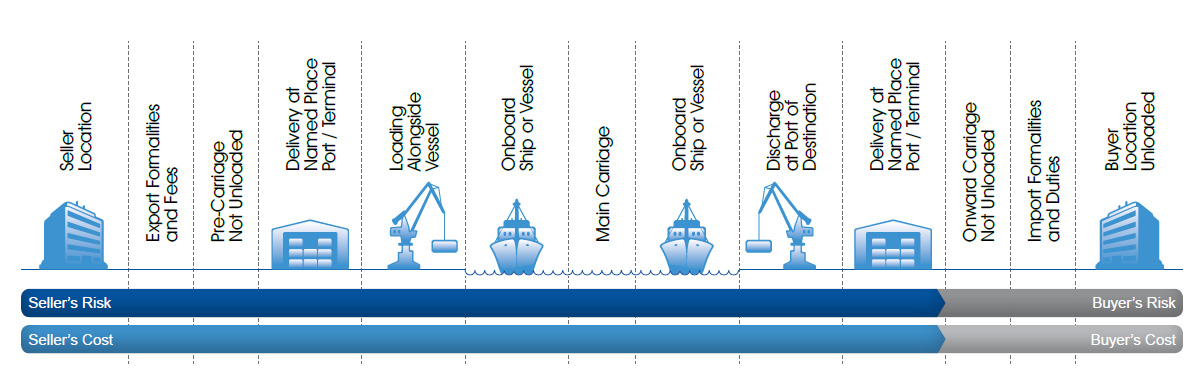

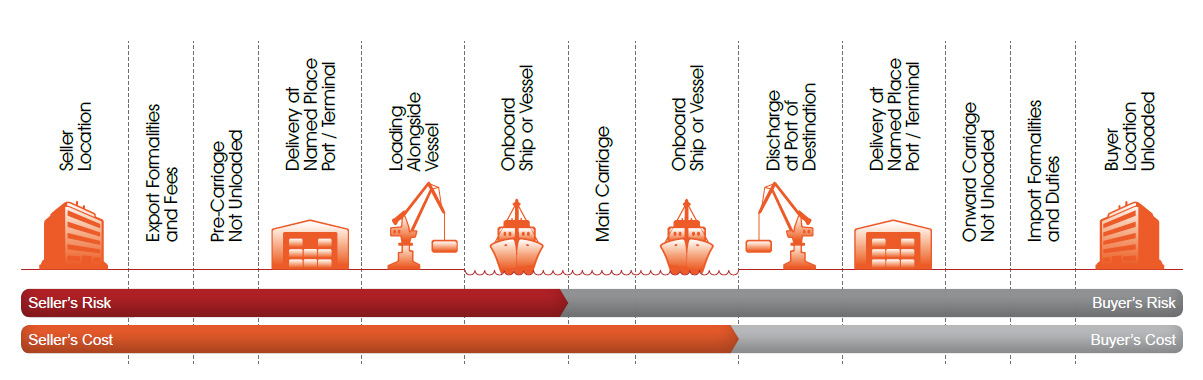

10. CFR Incoterms – Cost and Freight (named port of destination)

Cost and Freight (previously known as C&F) require the seller to clear the goods for export, deliver them onboard the ship at the port of departure and pay for the transport of the goods to the named port of destination. The risk passes from seller to buyer when the goods are delivered onboard the ship.

The transfer of risk from seller to buyer occurs at a different point than the transfer of cost. Actual risk passes to the buyer once the goods are loaded on the vessel.

Note that it is not the seller’s job to clear the goods through customs. The buyer is responsible for paying all additional transport costs from the port of destination as well as import clearance, insurance and duties.

CFR is used for ocean or inland waterway transport only.

If the freight is containerized and delivered only to the terminal, the use of CPT is recommended.

Seller’s Obligations

- Goods, commercial invoice and documentation

- Export packaging and marking

- Export licenses and customs formalities

- Pre-carriage and delivery

- Loading charges

- Delivery at named port of destination

- Proof of delivery

Buyer’s Obligations

- Risk starting onboard vessel

- Discharge and onward carriage

- Import formalities and duties

- Cost of pre-shipment inspection

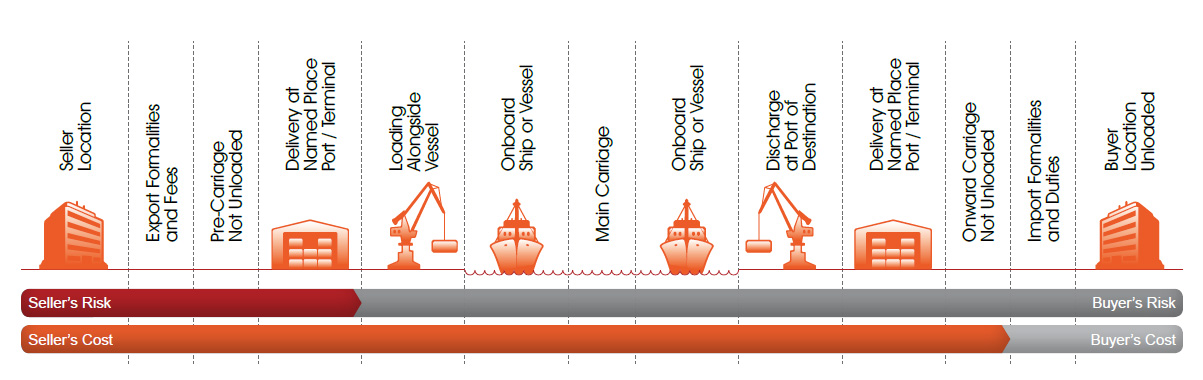

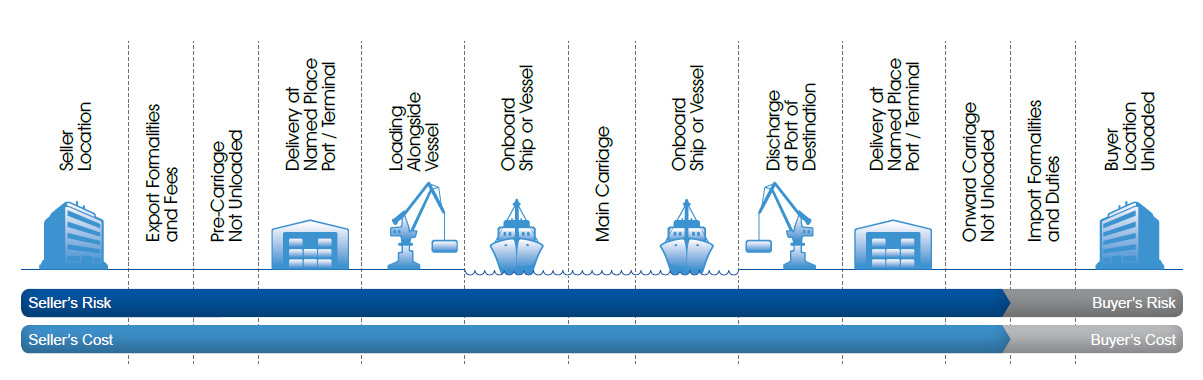

11.CIF Incoterms – Cost, Insurance and Freight (named port of destination)

CIF is a very common format and it is identical to CFR: the only difference is that the seller also pays to ensure the merchandise.

In Cost, Insurance and Freight, the seller is responsible for delivering the goods onboard the vessel at the port of shipment – not port of destination. In addition, the seller is paying for the transport and obligated to secure insurance, but only for minimum coverage to the named port of destination.

The buyer assumes all risk once the goods are onboard the vessel for the main carriage, but does not assume costs until the freight arrives at the named port of destination.

CIF applies to ocean or inland waterway transport only. It is commonly used for bulk cargo, oversized or overweight shipments.

If the freight is containerized and delivered only to the terminal, the use of CIP is recommended.

Seller’s Obligations

- Goods, commercial invoice and documentation

- Export packaging and marking

- Export licenses and customs formalities

- Pre-carriage and delivery

- Loading charges

- Delivery at named port of destination

- Proof of delivery

- Insurance

Buyer’s Obligations

- Risk starting onboard ship

- Discharge and onward carriage

- Import formalities and duties

- Cost of pre-shipment inspection

Old Incoterms 2000 types that are not in Incoterms 2010

As mentioned earlier, the parties may choose to use older terms, and the following that is no longer specified by the ICC may still be encountered.

DAF – Delivered at Frontier (named place of delivery)

For rail and road shipments. Seller pays for transport to the country frontier. Buyer arranges for customs clearance and pays for transport from frontier to his site. Risk passes at the frontier.

DES – Delivered Ex Ship (named port of delivery)

You may come across this with bulk commodities where seller owns or charters their own vessel. Unlike CFR and CIF, the seller bears not just cost, but risk and title until the arrival of the vessel at the delivery port. Buyer pays to unload plus customs duties, taxes, etc.

DEQ – Delivered Ex Quay (named port of delivery)

The same as DES, except risk passes only when goods are unloaded at the destination.

DDU – Delivered Duty Unpaid (named place of destination)

Seller delivers the goods to the ultimate destination in the contract. The goods are not cleared for import or unloaded. The buyer is responsible for all costs and risks beyond this point. Any variation must be explicit in the contract.

What is the legal status of Incoterms?

It is important to note the limitations of Incoterms. They do not replace the many and varied legal systems that apply in the world’s countries and trading blocs: and it is these often infuriating legal minefields that freight forwarders encounter daily and in so doing, fully justify their fees.

Incoterms are designed to codify basic concepts of risk, the allocation of costs, the point at which delivery takes place, and the responsibility for insurance. This has been hugely beneficial to world trade: it allows insurers to operate effectively at a global level and for all the countries which adhere to the Incoterms rules (that is, most of them) it oils the wheels (and keels) of trade.

What International Commercial Terms do not cover are the issues like who covers the goods before and after the delivery process; who pays VAT or other sales taxes; the precise nature of the contract between buyer and seller (although ICC does have model contracts and clauses, these are not legally binding); or when things go wrong, how alleged breaches of contract are settled. The sales contract will state which country’s legal system will apply in that event.

International legal harmonisation on trade law issues is something that UNICTRAL has been working on for many years, with some success, but much remains to be done.

Other moves that will help international trade have come from the Rotterdam Rules, endorsed by 22 countries accounting for 25% of world trade – they allow for multi-modal door-to-door shipments to have built-in liabilities and insurance issues contained within individual contracts. Another potential step forward towards contractual uniformity comes from the 59 countries (including France, China and the United States but not yet the UK) that are signatories to the U.N. Convention on Contract for the International Sale of Goods (“CISG”).

Further Information

International Chamber of Commerce (ICC)

Wikipedia Article on Incoterms